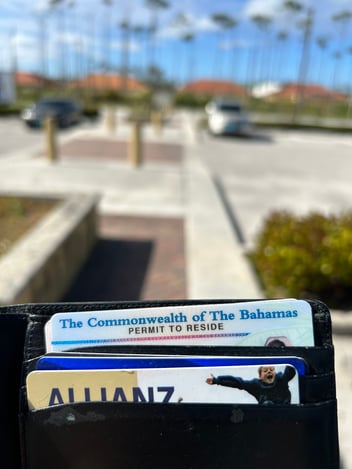

- Tax advantages: Grand Bahama Island, like the rest of The Bahamas, offers attractive tax benefits for expatriates. There is no personal income tax, capital gains tax, or inheritance tax, making it an appealing destination for those seeking to minimize their tax liabilities.

- Beautiful natural surroundings: Grand Bahama Island is known for its stunning natural beauty, with pristine white sand beaches, crystal-clear turquoise waters, and vibrant coral reefs. Expatriates can enjoy a tropical paradise as their everyday backdrop, providing a relaxed and idyllic lifestyle.

- Economic opportunities: Grand Bahama Island has the only Free Zone in The Bahamas. It has the biggest container port and a diverse economy, with sectors such as tourism, financial services, and light manufacturing contributing to job opportunities for expatriates. The island has a growing offshore financial industry and offers a business-friendly environment for entrepreneurs and investors. See more on the official government website https://investgrandbahama.com/

- Cultural diversity: The Bahamas, including Grand Bahama Island, has a rich cultural heritage influenced by African, European, and indigenous traditions. Expatriates living on the island have the opportunity to immerse themselves in this vibrant cultural mix, participating in local festivals, crafts, cuisine, and music.

- Close proximity to the United States: Grand Bahama Island is just 55 miles away from the coast of Florida, making it easily accessible for expatriates from the United States. This proximity offers the advantage of convenient travel, with frequent flights and short travel durations, allowing expatriates to maintain strong ties with family, friends, and business connections in the U.S.